4 Painless Ways to Save Money for Travel

“You don’t have to be rich to travel well.”

– Eugene Fodor

This quote is so true…and is the basis for my blog about budget travel.

I remember the first trip I paid for myself. I was 17 and working at Baskin-Robbins where I made a whopping $4 an hour.

Since my mom was a single parent and had to pay the bills on her own, there was no money for a vacation that summer, but I really wanted to go to the beach like we always did.

I told my mom I’d treat her and my two brothers to a week at the beach. To say she was skeptical would be an understatement!

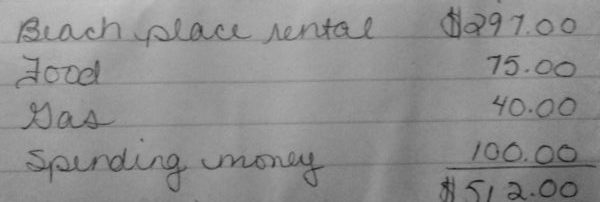

However, despite her skepticism, I moved forward with my plan. I found a place to stay, estimated how much money I’d need, and worked as many hours as my boss would schedule me.

Six weeks and many double-shifts later, I had earned enough money to pay for the rental, groceries, gas, dinner at our favorite pizza place, and spending money for myself.

The moral of the story: you can accomplish whatever you set your mind to regardless of your age or income.

4 PAINLESS WAYS TO SAVE MONEY FOR TRAVEL

Let’s be honest. The thought of saving money often brings to mind thoughts of huge sacrifices and depriving ourselves of the things we love.

But…there are several ways to save money by spending money.

Sounds crazy, doesn’t it? But it IS possible.

Don’t believe me? That’s ok. I’m gonna “put my money where my mouth is” so to speak.

If you’re ready to learn some painless ways to save money for travel, read on.

[bctt tweet=”There are several ways to save money by spending money. Sounds crazy but it IS possible.” username=”@whereisatb”]

1. Earn Cash Back on Everyday Purchases

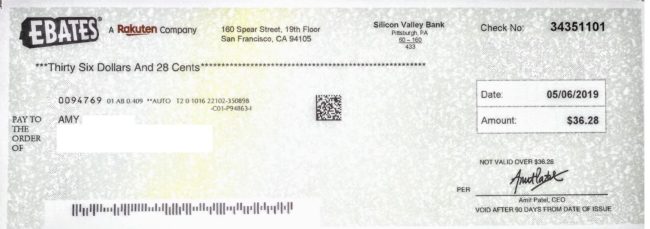

RAKUTEN (FORMERLY EBATES)

If you shop online (like most of us do), then this is for you. Sign up for a free Ebates account and you’ll earn cashback on online (and some in-store) purchases from stores who are Ebates partners.

Some of the 2,500 stores that offer cash back on purchases include biggies like Walmart, Amazon, Overstock, Target, and more.

Shopping categories include clothing; shoes and handbags; health and beauty; electronics and computers; home, garden, and tools; sports and outdoors; and of course, travel.

The cashback percentage offered varies from store to store. To make sure you earn the most cash back on your purchases, you can sort retailers by cashback and the listings will be displayed from the highest cashback percentage to lowest.

You can earn money 2 ways: (1) by shopping and (2) by referring others. You’ll receive quarterly checks for the cashback that you’ve earned.

I’ve been an Ebates member for several years and LOVE it! Here’s a picture of one of my checks (before they officially changed their name to Rakuten):

* If you earned even $25 per quarter, you’d have $100 in 1 year. That’s more

than enough to pay for a hotel room for 1 night at most hotels. Good start, right? *

2. Save By Rounding Up Your Money

KEEP THE CHANGE

If you’re a Bank of America customer, you can join Keep the Change, their automatic savings plan. Through Keep the Change, your purchases are rounded up to the nearest dollar and the difference is put into a savings account. Think of it as the digital version of emptying your pockets at the end of the day and putting your change into a jar.)

For example, if you make a purchase of $1.35, rounding up to the nearest dollar would make your total purchase $2 and the $0.65 difference would be transferred into your savings account.

To qualify for Keep the Change, you must be a Bank of America customer and have a checking account with a debit card and a savings account.

If you don’t have enough funds in your account to cover your roundups for the day, Bank of America cancels the Keep the Change transfer(s) for that day in order to protect you from overdraft.

Although the interest offered on savings accounts is negligible, setting up an automatic savings plan like this makes putting money aside painless since its just a little bit at a time. However, a little bit can add up faster than you think

Here are a few other noteworthy resources for you to consider: Qapital, Tip Yourself, Chime.

If you only saved $0.65 every day like in the example above, you’d save $237.25 in 1 year.

That’s enough to cover your hotel room for 2 nights/1 weekend and then some! *

NOTE: There are other apps and programs that are similar to Keep the Change, but many of them, like Acorns, charges you a monthly fee or a fee if your savings balance is or falls below their pre-set minimum.

3. Earn Cash Back at Gas Stations, Restaurants & Grocery Stores

GETUPSIDE

Get Upside is a free app that allows you to earn cash back on gas (up to $0.25 cash back per gallon); groceries (up to 15% cashback); and food and drinks at restaurants (up to 35% cashback). In addition to gas purchases, you can also save on purchases made in the gas station’s convenience store, car washes, and more.

In order to qualify for cashback earnings, your purchases must be made using a debit or credit card. Once you claim an offer, you have 4 hours to take advantage of it. After you’ve made your purchase and gotten your printed receipt, upload a photo of your receipt inside the app. Within 24 hours, the cashback you earned from your purchase will be applied to your account.

You can cash out and get your money via Paypal or by check. If you decide to cash out via PayPal, there is no fee for amounts over $15. If you decide to cash out via check, there is no fee for amounts over $50.

I recently learned about GetUpside from a radio commercial and tried it before recommending it to you (of course). I can tell you from my personal experience that it works as promised.

At the time of writing this blog post, I drive for Uber part-time and use the app every time I buy gas. In the month since I’ve been using GetUpside, I’ve earned about $25 on my gas purchases.

That could pay for an entire weekend – hotel and some meals.*

=> Use promo code 42R8T when you join GetUpside & get an extra $0.25 per gallon off your 1st gas purchase of $10+ <=

4. Challenge Yourself to Save Every Week

THE 52 WEEK SAVINGS CHALLENGE

Saving money can be hard. No argument. But if you make it into kind of a game or challenge, it becomes a little less tedious and a little more fun.

The premise of the 52 Week Challenge is that a person starts saving money (ideally at the beginning of a new year, but you can start anytime you want) and makes a deposit each week. The amount of the deposit corresponds to the week number.

For example, week 1, you deposit $1; week 2, you deposit $2, and so on through week 52 (see the illustration above).

This could pay for an amazing vacation, several weekends away…you choose.*

If you truly want travel to be part of your life, take action today. Choose 1 of the options above and get started. You’ll be further ahead than if you did nothing and small amounts add up quickly.

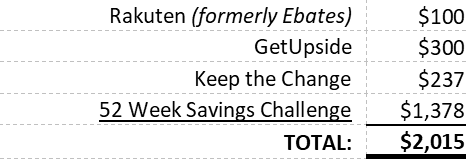

Using the examples above, your estimated savings after 1 year would be:

Do YOU have any tips for a painless way to save money?

Please share in the Comments below.

![[Video] How to Travel for Less: Budget Travel Tips from Millennials](https://www.travelingbroad.com/wp-content/uploads/millennial-travel-header-e1541949876990.png)